There are various reasons why a bank or financial institution can freeze your bank or financial institution account:

- Your failure to comply with the KYC (Know Your Client) and AML (Anti Money Laundering);

- Because of a court order due to civil doubts or civil claims;

- Because of a court order as a cautionary measure in a criminal investigation.

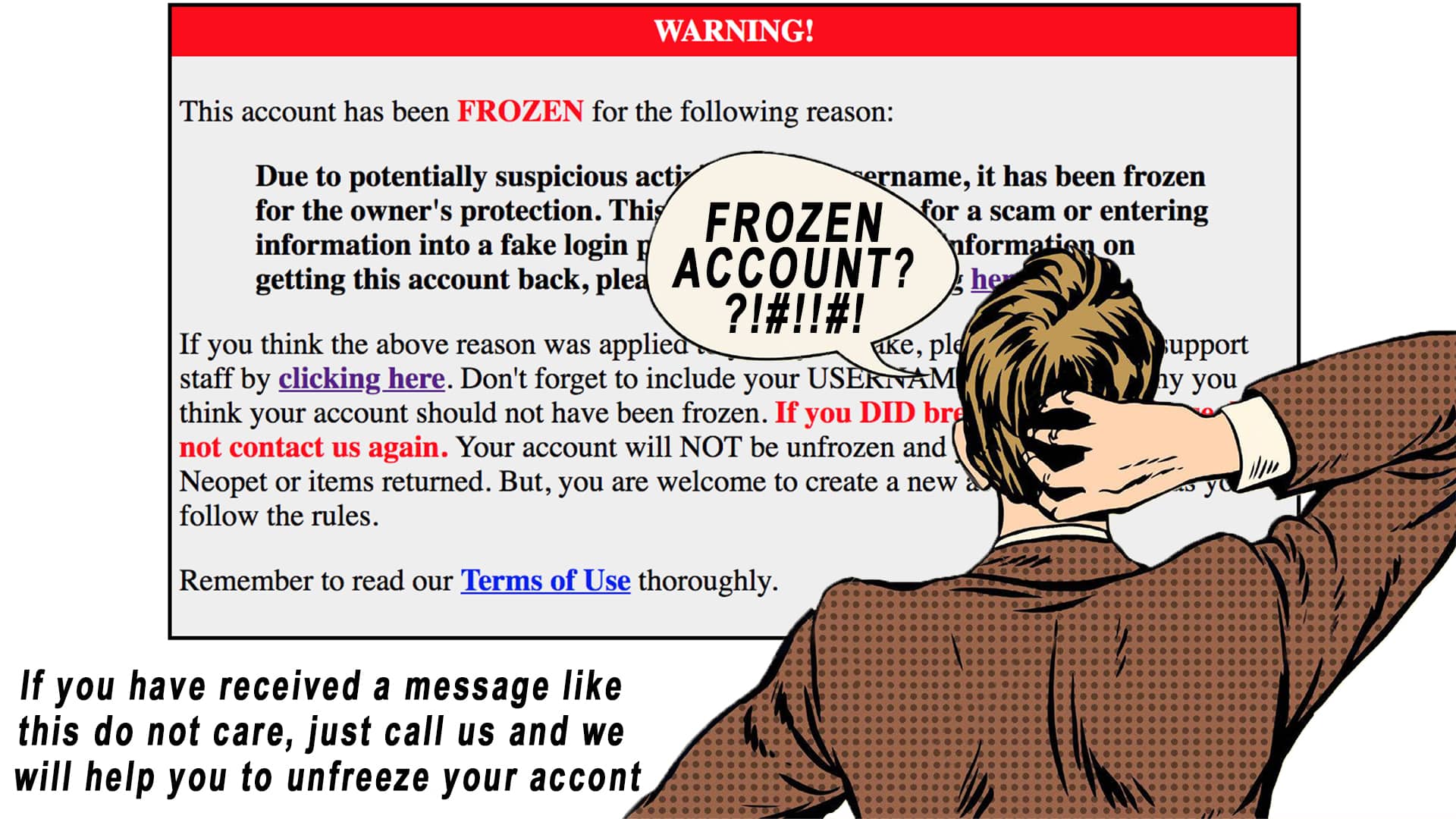

In some of these cases you have to act quickly and appropriately. Generally, when your account is frozen, you can receive funds; however, you can’t withdraw them. This means that if you haven’t created a secure deposit or don’t keep reserves under your mattress, you can neither pay your accounts nor have the funds to hire a lawyer who can help you to unblock your account.

Even though it doesn’t seem like it, the cases of frozen accounts are more and frequent, for the most diverse reasons and, unfortunately, since no one expects them, the damages are frequently serious. Offshore banks and financial institutions systematically abuse the KYC and AML norms and, with this excuse, think that they can take your money while they annoy you with absurd requirements.

The Caporaso & Partners has dealt with hundreds of these cases and has specialized in unblocking frozen accounts and these days, thanks to their experience in this field, can help you unfreeze a frozen account.

Other than these court ordered lockups of bank accounts, whose legality is doubtful in many of these cases, there is an abnormal increase in lockups made by banks and financial institutions and that in the majority of these cases a legal basis is completely lacking. However, how can you argue with the person who is in control? They have our silver and force us to waste more silver complying with demands that without a doubt don’t give them the right to block an account. Furthermore, are thee demands always legal?

Precautions to avoid freezing the accounts

Actually, in 90% of the cases, the restrictions applied to a bank, financial institution or even a PayPal account are completely illegal. The problem is that going to court to demand our rights is an expensive and slow process, so we always try to use alternate means of pressure to obtain quick access to our blocked funds.

We advise you to prevent these situations in the following manner:

- Don’t open accounts with incomplete documentation or which can’t be renewed;

- Keep your savings and capital in various accounts, in various countries, so that you always have access to emergency funds;

- Investigate the bank’s or financial institution’s history with account lockups so you can evaluate the risk;

- Never think it will never happen to me!

- The more money you have, the more protection you need: get good advice and, with time, it will cost you less and it is better to prepare than to complain.