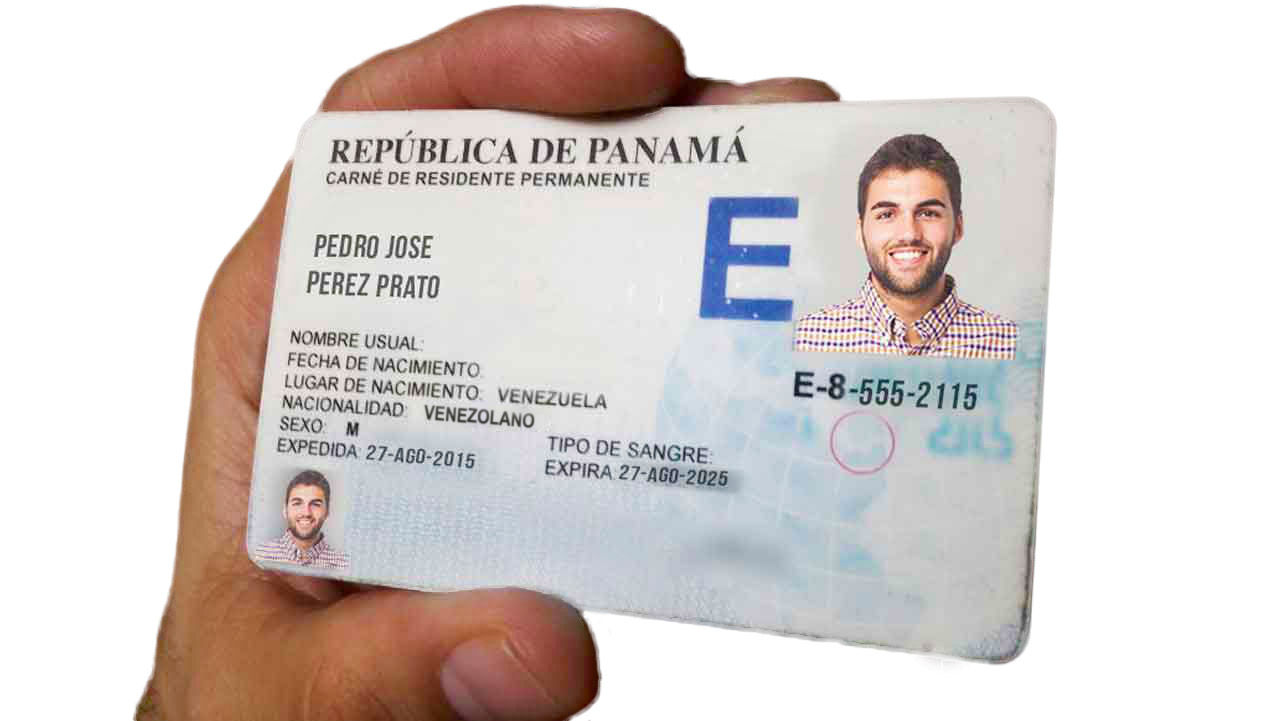

Citizens from friendly countries can make use of the permanent residence permit in Panama, provided for in the Executive Decree n. 343 of 16 May 2012.

Why is residence in Panama advantageous?

The following countries are considered friendly for the purpose of obtaining permanent residence: Andorra, Argentina, Australia, Belgium, Brazil, Canada, Chile, Costa Rica, Croatia, Cyprus, France, Germany, Greece, Hong Kong, Czech republic, Denmark, Estonia, Finland, Hungary, Ireland, Israel, Japan, Latvia, Liechtenstein, Malta, Monaco, Lithuania, Luxemburg, San Marino, Mexico, Montenegro, Netherlands, New Zealand, Norway, Paraguay, Poland, Portugal, Serbia, Singapore, Slovakia, Spain, South Africa, South Korea, Sweden, Switzerland, Taiwan, United States of America, Uruguay, United Kingdom.

Requirements for permanent residence in Panama

Citizens belonging to the list of friendly countries can make use of the permanent residence permit, provided for in the Executive Decree n. 343 of 16 May 2012, which is obtained in only 10 business days (7 days for the temporary permit and 3 for the permanent).

The National Immigration Service of Panama has the migratory entering and leaving movement of national and foreign residents in the country as its regular objective. The residence of the latter in the national territory, granted by treaties, conventions, international agreements and special laws, valid for the Republic of Panama, is therefore granted or denied by that organization. Through the Executive Decree n. 343 of 16 May 2012, citizens that are part of the list of friendly countries can exercise economic and professional activities in the Panamanian territory.

The National Immigration Service of Panama determines, through this resolution, the requirements and procedures for the citizens who can benefit from their migratory status, depending on whether the Decree permits it. The requirements and procedures for obtaining permanent residence in Panama:

FIRST: request a permanent residence permit through a lawyer.

SECOND: the residence permit will be granted exclusively to foreigners belonging to the list of friendly countries. The temporary permit can be obtained in just 7 days, but for the issuance of permanent permits, the law and immigration authorities haven’t established a limit on the delivery date, and this period can go from 3 to 6 months. During this period, the applicant can’t leave the country unless he requests an entry and departure visa, showing his reasons; this is an easy procedure and costs 200 USD. Once you have obtained the temporary permit, we’ll notify you when you can withdraw the permanent permit. Withdrawing the permanent permit takes 1-2 days.

THIRD: Citizens who request the permanent residence permit are exempt from a repatriation deposit.

FOURTH: In the application, it will be argued that citizens requesting a permanent residence permit, based on the Executive Decree n. 343 of 16 May 2012, have the intention of exercising commercial and economic activities of any kind, conforming to the requirements of Article 28 of the Executive Order n. 22 of 22 February 2008, must provide the following documents with apostille (keep in mind that in some cities it takes up to 15 days to get an apostille. Apostilles for criminal certificates are obtained in the court, municipalities in the same town or designated office):

What to do in your own country:

- Criminal Certificate with apostille, sent within 30 days after the request;

- Birth Certificate with apostille, where the names of your parents appear;

- Five (5) passport photos (this can also be done in Panama, but you’ll lose time);

What to do in Panama:

- The documents certifying the intention of requesting permanent residence, depending on the economic or professional activity you will be carrying out, it will be necessary to set up a Panamanian business (price: 1,300 EUR). Establishing the business will take some 10 business days and therefore, it is better to act quickly, before traveling;

- The proof of financial solvency of the requester, which must be proven by certification by a Panamanian bank or the bank account statement from the preceding month, with a balance of no less than four digits or by other means that can prove your income , which is acceptable to the National Immigration Service of Panama. It’s possible even though very difficult, to open a personal account in a local bank in 24-48 hours with the necessary documents (if the client requests our help, a fee of 1,300 EUR will be applied).

- Copy of ID;

- Passport or citizenship certificate or logbook, issued by the corresponding authority of your country who vouches that the holder is a citizen of said nation;

- Sponsorship letter, and income certificate, in the case you are an independent worker;

- Translation of the documents by an authorized Panamanian public translator (send it to us quickly because it’s probable that yours won’t be the only ones to be translated; this is the e-mail address: [email protected]). If there’s no translator from your language to Spanish in Panama, you can translate the documents in your country and add an apostille or in the Panamanian Consulate.

Legal basis: Executive Decree n.320 of 8 August 2008, which regulates the Government Decree n. 3 of 22 February 2008, created by the National Immigration Service of Panama, and other dispositions, published in the Official Gazette of Panama n. 26104.

Commissions and expenses for obtaining permanent residence permits in Panama, based on the Executive Decree n. 343 of 16 May 2012: 2,000.00 EUR.

Take Note: The applicant must submit all documents, with apostilles duly affixed, to our office and pay for the translations (fee depending on language). All other expenses are included in our fee. If you get estimates or prices from other offices, it’s possible that the expenses are separate from the requested fees and that they propose a price of only their professional fee so that they appear more attractive. We offer an “all inclusive” price, excluding options or services unnecessary for the residence or any cost and service requested after obtaining the residence,

In case of errors (at times the name can be written incorrectly or something similar), our office guarantees complaint of the same in a normal timeframe; if you are in a hurry, we’ll assign you an assistant, at the cost of 25 USD per hour (minimum 4 hours). Keep in mind that this is a type of residence for people who, theoretically, are established in the country and, therefore, the authorities won’t work in a big hurry.

The citizens who wish to take advantage of the benefits of the Decree must comply with the Panamanian laws and regulations in commercial, work or any other matters, on the basis of the professional or economic activities they intend to carry out.

Summary of costs

Cost of Residence in Panama: 2,500 EUR (everything included, except documentation that the client must provide). Optional services and those unnecessary for the residence, or any other service requested after the residence has been obtained are not included.

Time for obtaining the residence

If you have everything listed on your arrival, you will obtain the temporary residence in 7 days and, in a period of 3-6 months you will obtain the definitive permit (we will advise you when the Decision is made). After the notification has been made, you have 30 days to personally withdraw it in Panama and it is usually done within 1-2 days. The record is archived after 30 days so that, if you arrive after the established deadline, you will have to pay an additional amount of 200 USD to look in the archive.

During this trip, you will have to pay the costs for a new immigration card (100 USD), and if you want, you can request an ID card, driver’s license (you need to bring a Certification of your license with Apostille, translated into Spanish, etc.); obtaining these documents can take around 15 days and the COST IS NOT INCLUDED. We advise you to obtain the driver’s license or ID card, since many bans require 2 documents of the country of residence; generally, everything is done within the given times: we say generally because here there are many holidays, bridges, officials who become sick and all this slows down the processing speed.

Exit Visa

In theory, this type of residence is for those who live in Panama; from 3-6 months can go by between the temporary permit and the permanent permit and therefore, if you want to leave the country between requesting the residence permit and obtaining the permanent permit, it’s necessary to request an exit permit that costs 200 USD which you will obtain in 2 days. If you leave the country without a visa, they will give you a very high penalty and it can compromise the process for obtaining the permanent residence.

Work permit: Only if you require a work permit for those who desire to work for third parties in Panama and has a single cost of 1,200 USD.

Panama Company: Cost 1,300 EUR

Personal express bank account: Cost 1,300 EUR

Expenses for obtaining a Panamanian passport

- Minimum deposit in the Panama National Bank or the Savings Bank: from 800,000 to 1,000,000 USD

- Minimum monthly income required, deriving from this deposit: 2,000 USD Fee for mediation: 10,000 USD

Panama implements new permanent residence program for foreign investors

The Panamanian government, presided over by Laurentino Cortizo, approved a new permanent residence program for economic reasons for foreign investors. This program seeks to attract more foreign investors who contribute to reactivating Panama’s economy. This country has suffered a serious recession because of the Covid-19 pandemic.

Requirements for applying to the permanent residence program

In accordance with the Executive Order N. 722 of October 15, 2020, to apply for this program, the foreigner must invest a minimum of 300,000 American dollars in real estate, during the first two years of the decree’s validation. From the third year, the amount goes up to 500,000 dollars. These property investments can be in finished units or also in those still under construction.

Another way to apply for the permanent residence program is to purchase securities in the Panamanian Market, for a minimum amount of 500,000 dollars. Additionally, it will be necessary to establish fixed bank terms for a minimum of 750,000 dollars.

Steps for applying for Panama’s residence program

The applicant will be able to initiate the application from outside the country, through a Panamanian lawyer. Nevertheless, he will have to finish the formalities in Panama. When he reaches the country, he will continue the process through the only investment window of the Ministry of Commerce and Industries, where the National Migration Services will intervene. The latter is in charge of controlling that the investor complies with the Panamanian migration and security norms.

The documentation tat the investor will have to present will depend on the investment type. The process lasts 30 days, after the first certification of the investment has been approved. The applicant will receive his permanent residence after completing the process, although he will have to keep his investments for a minimum five years.