Table of Contents

What is the Flag theory?

The Flag Theory is a strategy that suggests the creation of a diversified international structure so that a person’s business and wealth don’t depend on any government.

The inventor of the Flag Theory was Harry D. Schultz, who was the investment adviser for businessmen.

According to Schultz’s theory, every entrepreneur had to divide his business into three different places, under three different flags, where each different flag stood for a different tax jurisdiction.

Schultz contemplated the theory of the three flags in the 1960s and had a certain success in the business world.

The 3 flags of the Flag Theory

The three flags of Schultz’s theory are the following:

Second passport: Obtain a second nationality; it can always serve as a plan b.

Set up your offshore company: Establish your business in a jurisdiction that applies a very low, or no, company tax.

Obtain residence: Live in the place you like most, possibly in a tax haven, where you can spend your time the best way, just as you like it.

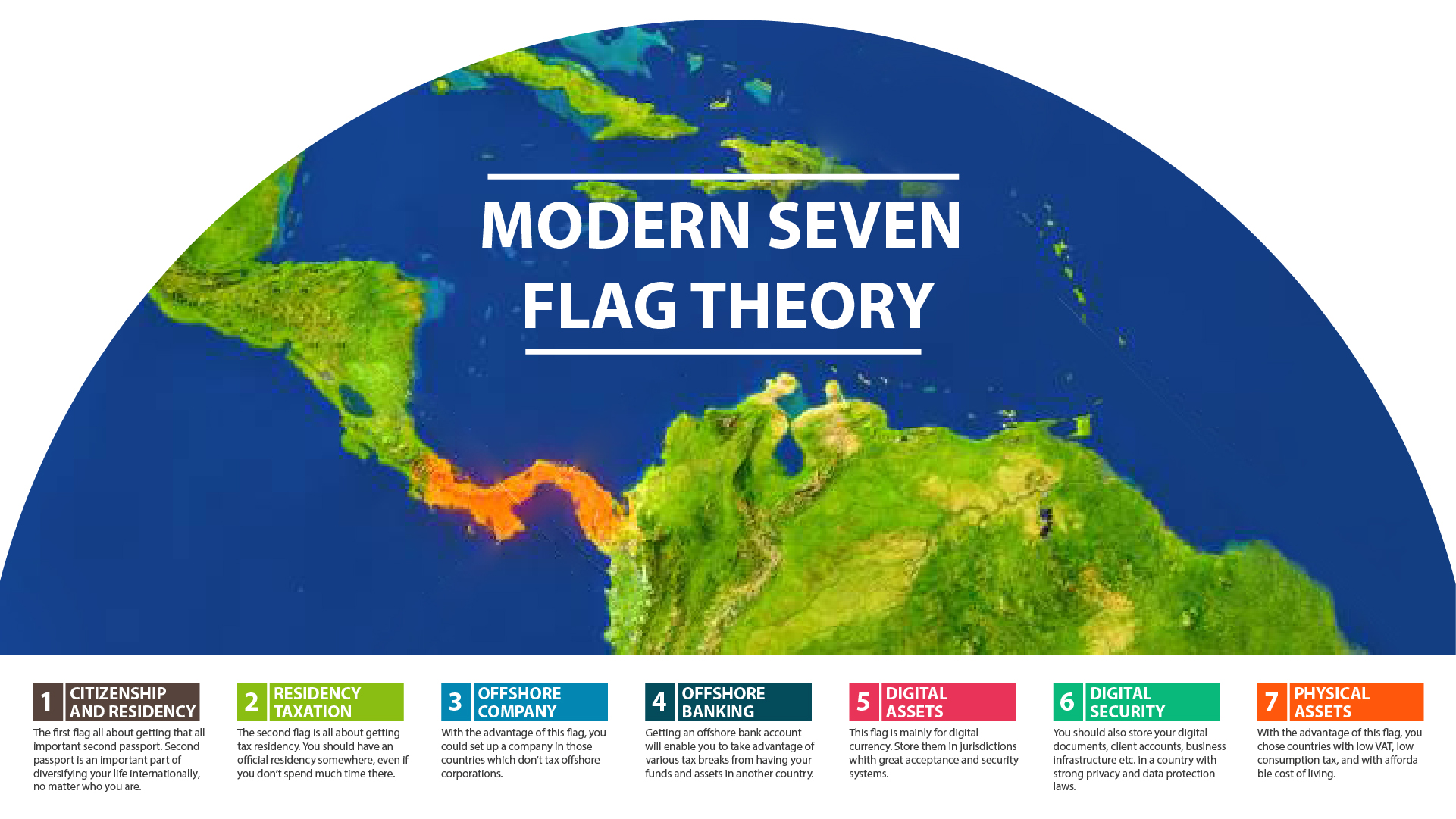

Subsequently, the theory was taken up again and interpreted more widely with five flags, whereas the most updated version has arrived at suggesting seven flags.

The company 7 Flag Theory must be taken as a general indication. It doesn’t necessarily mean that the entire world needs seven flags, but serves to indicate a series of possible diversifications and each person chooses the ones he actually needs.

Given the exceptional times we’re living in, with an economic crisis and a pandemic, the suggestions of the Flag Theory must be very much taken into account.

International diversification is more than ever a prudent choice, since it is feared that an unprecedented crisis, due to the economic consequences of the Covid-19 pandemic, will unfold.

Applying the flags theory, we can obtain the following benefits:

Advantages of the flags theory

- Significant tax reduction.

- Greater privacy in your assets.

- Living according to the lifestyle best adapted to each person’s aspirations.

- A much quicker increase in the value of your assets/

- Greater stability for your business, since you’re not exposed to the comings and goings of politics.

1)Obtain a second passport

Having a dual nationality is perfectly legal and is the first point of the Flag Theory. It’s an important point because it takes away dependence on any government. It makes us feel like we own our selves and are responsible for our destiny, allowing ourselves to widen our assessment of opportunities outside the national context.

None of chose to live in a country that asks us to pay 50% taxes on our earnings. With the second citizenship, we can choose to escape this imposition and we can go live in a country that requires a tribute that we are willing to pay.

2) Establish your company abroad

Establishing your company in an offshore jurisdiction that applies low taxes on businesses can give your company a significant boost. It can also provide you with an important competitive advantage over your competitors.

However, one of the most important advantages is, without a doubt, the protection of your privacy and that of the activity you wish to create. You could use your business for managing your assets, or for the purchase and sale of offshore properties, management of author’s rights or licenses, the collection of dividends and interest, etc.

Another factor that can help improve operational results is the location. See if the country where you want to plant your flag has a legislation favorable for business development. And also whether there are human resources available who can enter your sector with competitive salary costs. In this case, you will have found more strong points in favor of developing your business.

3) Obtain your residence in a tax haven

Establishing your residence in a tax haven is the third point of the Flag Theory. After planting your first two flags, the third is to get your residence in a place that doesn’t collect taxes on personal income generated abroad.

This way, income from the foreign country and from the offshore company will be tax-free.

Further, Harry D. Schultz also suggested that your place of personal residence should be a pleasant place, with the lifestyle that the person likes and which also allows him to enjoy himself and relax.

This third point slightly represents the place of gratification and freedom that the entrepreneur gives himself after building his business’ international structure and his personal fiscal position.

4) Offshore bank account

Open an offshore bank account in a stable country with a strong economy. The fourth flag is to choose a bank located in a different country than that of the offshore business or that where you have fixed your personal residence.

The ideal place for opening an offshore bank account must have a very efficient judicial system. Other important characteristics are a well-respected foreign banking system, a traditionally stable government, and which offers profitable types of interest for deposits.

The bank account can be personal or for the business, but in either case, it will be much safer if it’s in a completely different place than that of your residence or company.

The diversification of the bank account also has the objective of protecting your assets, taking advantage of greater stability, being protected from possible claims or attempts at blocking the account, and collecting higher interest rates.

5) Investing in patrimonial assets

The fifth flag is the formation of patrimonial assets from tangible investments. One of the most common investments is gold and other precious metals like silver. On the other hand, investments in real estate or land are another long-term investment strategy which rises in value with time and protects against inflation.

One of the trends that has consolidated in the last 10 years around the world is buying land for agricultural use. It has been observed that big foreign multinationals and Chinese state-owned businesses are making huge purchases of cultivatable land on all of the continents.

The continuous increase in population makes one think that within 20 years there will be a shortage of food and water, meaning that big businesses and States are running to hide.

That’s why investing in agricultural land can be a profitable investment.

If you decide to make this type of investment, the assistance of a layer is advisable, since, especially in the case of foreign investments, scams are fairly common.

However, this shouldn’t make you desist; on the contrary, when you consider an investment, do it and ask for help from experts so that the operation finishes in success.

6) Digital security and freedom

We’re in the age of digital businesses and having one or more websites that support our company and generate income is vital. But, what if the economic sector where you work is controversial? The fact that may be controversial doesn’t mean it’s illegal. However, there is the risk that it can be interpreted differently according to the laws of different countries, or according to the religions of other countries, or for many other reasons.

Since we can’t risk having our website being taken from us, deciding in which hosting to put our website is of maximum importance.

In recent years, countries that offer greater guarantees and protect against arbitrariness have popped up. These are countries like Iceland, Switzerland, Norway and the Netherlands, which protect websites abuse of power from some big technology companies and protect freedom of expression.

So, in this case, applying the Flag Theory to our website’s hosting is more than justified and is the essential point for protecting our company.

7) Investing in digital assets

The last flag of this theory refers to investments in Blockchain and cryptocurrencies. These investments have the particular characteristic of offering a measure of privacy and aren’t attributable to any country in particular.

So, cryptocurrency transactions give immediate access to the internationalization of the investment, a characteristic that only the blockchain can offer. The blockchain has its own particular form of self-registration that dispenses with the presence of a third party to validate the transaction.

So, investments in cryptocurrencies join the ideal characteristics that convert it into a legitimate part of the strategy for internationalizing investments.

Cryptocurrencies continue to be extremely volatile, and an investment in these digital assets must be wise and prudent. However, it’s an area that should be watched and considered, inasmuch as payments with cryptocurrencies are becoming more and more popular, and the adoption of cryptocurrencies as investment assets is expanding.